Long term care costs can hit close to home.

There’s an expense lurking down the road for many retirees that is largely unpredictable but likely: long-term care. A well-designed LTC Insurance plan can help cover all or a portion of long-term care costs. We can help you understand your options and plan for your future, so you can enjoy your present.

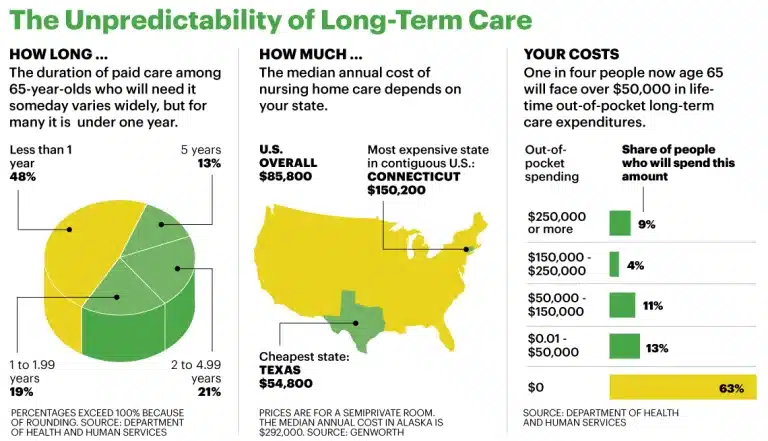

More than half of Americans over 65 will need long term care at some point in their lives. No matter when you plan to retire (or where), it’s important you know how you’ll pay for this type of care.

If you pay out of pocket, you’ll spend $140,000 on average. Yet you probably haven’t planned for that financial risk. Only 7.2 million or so Americans have LTC insurance, which covers many of the costs of a nursing home, assisted living or in-home care — expenses that aren’t covered by Medicare. Long-term care is the unsolved problem for so many people, knowing your options and creating a sensible plan is key.

Our clients end up getting the best possible rates and quality plans based on their particular circumstances. We do not charge any extra fees for our services.

Clients always ask about the new hybrid plans. This can eliminate the “use it or lose it” cost of long-term care. You may be able to exchange your existing life insurance policy, using a 1035 exchange, for a new life insurance policy with new living benefits feature. Some plans will now pay you a cash benefit versus being reimbursed for expenses incurred. This will allow for home care from family members or friends if you so choose. Cash benefit plans also allow you to select any type of care or service you wish from anywhere in the world.

Traditional long term care insurance and the new hybrid life insurance with living benefits now gives you options to protect your estate and your loved ones.