Highly Appreciated Assets-Capital Gains is a great approach to investing. Economic Opportunity Zones program was created by the Tax Cuts and Jobs Act (TCJA) in 2017, for economic growth. Designed to provide incentives to the private sector. Creating the ability invest long term in qualified low-income communities throughout the United States. The program seeks to utilize a portion of the trillions of dollars of unrealized capital gains for development in these designated areas.

Taxpayers can roll their gains into these new Qualified Opportunity Funds in exchange for potentially significant tax benefits. Investors in Qualified Opportunity Funds can defer the tax on the gains from the sale of assets rolled into the funds and, depending on how long they maintain the investments in such funds, they may receive an increase to their basis and tax free treatment on additional gains earned from funds invested in the fund.

Qualified Opportunity Funds can be set up as either corporations or partnerships and will generally need to hold at least 90% of their assets in Qualified Opportunity Zone Property acquired after December 31, 2017. To become a Qualified Opportunity Fund, an eligible taxpayer will self-certify. No approval or action by the IRS will be required. To self-certify, a taxpayer will merely complete a form and attach that form to their timely filed federal income tax return for the taxable year.

Opportunity Zones present a significant new opportunity both for Highly Appreciated Assets-Capital Gains as well as developers and business owners. We will continue to monitor this program and provide guidance and insight as it becomes available.

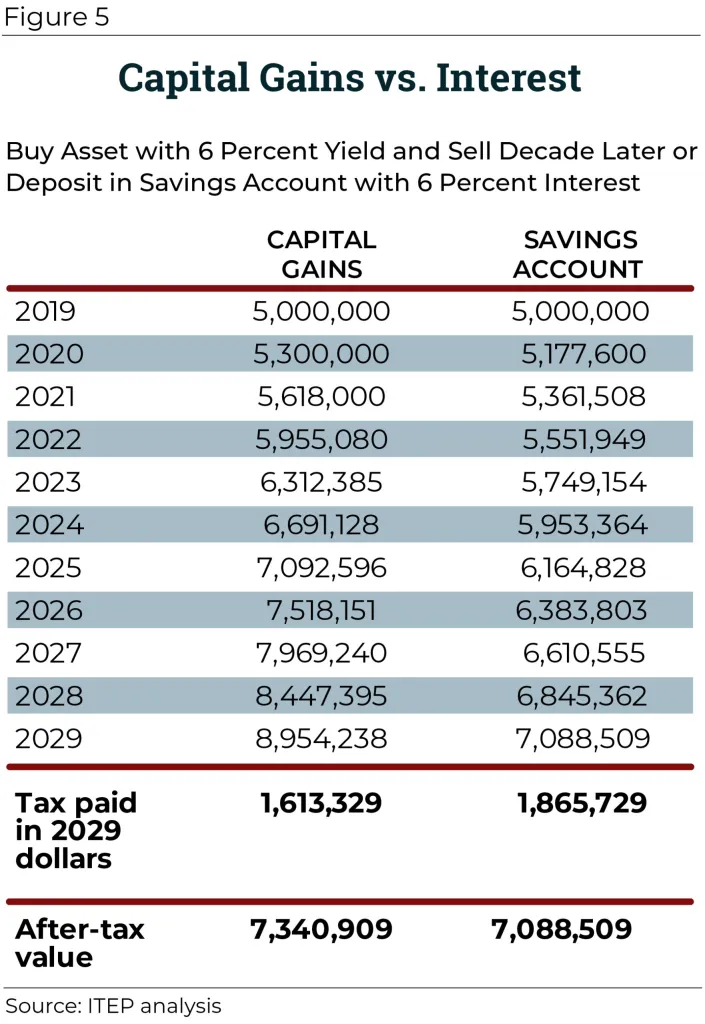

Capital Gains vs. Dividend Interest

There are two important advantages of investing in a QOZ Fund as opposed to entering into a Section 1031 exchange:

QOF Investments Require Less Investment to Defer Tax– To defer the tax on a gain, only the amount of the gain is rolled into a QOF within 180 days of the sale or exchange. The balance can be used elsewhere.

Example: Highly Appreciated Assets-Capital Gains

1031 exchange requires the entire value of the original property be reinvested into a new property in order to defer the tax . Section 1031 exchanges have a 45-day identification period and a 180 day window to complete the exchange.

Ted has a building with a value of $8,000,000 and has basis of $5,000,000. The sale of the building would trigger $3,000,000 of taxable gain for Ted.

To defer the tax through a QOF Ted only needs to invest the $3,000,000 gain into a QOZ Fund within 180 days. There are no restrictions on what the taxpayer does with the remaining proceeds of $5,000,000.

To defer tax on the entire $3,000,000 gain in a Section 1031 exchange, Ted would need to roll the entire $8,000,000 into a property. One that meets the 45 and 180 day requirements.

Less Restrictions on Type of Gains Invested in QOF– The new QOZ law places far less restrictions on the type of gain eligible for deferment. It only requires that the capital gain stem from a sale or exchange to an unrelated person. Real estate, personal property, intangibles assets, and virtually any other capital asset should qualify. In contrast, under the TCJA, eligibility for Section 1031 exchange treatment is now restricted to gains from the sale of real estate only.